Financial Recipes vol 1

The Two Pot Retirement System

The Two Pot Retirement System in South Africa Debunked what you need to know Administration fee for withdrawals:That’s right be aware that insurance companies will charge a fee to process these withdrawals Our favourite thing to do is pay tax right well this is what you can expect to pay in terms of these withdrawals […]

Saving for children’s education

Starting early and being proactive in saving for your children’s tertiary educationexpenses can have a positive impact on your finances. Some popular investment options for saving for education are an education policy (usually an endowment policy), unit trusts or exchange-traded funds, and a tax- free savings account. The choice of investment vehicle should be based […]

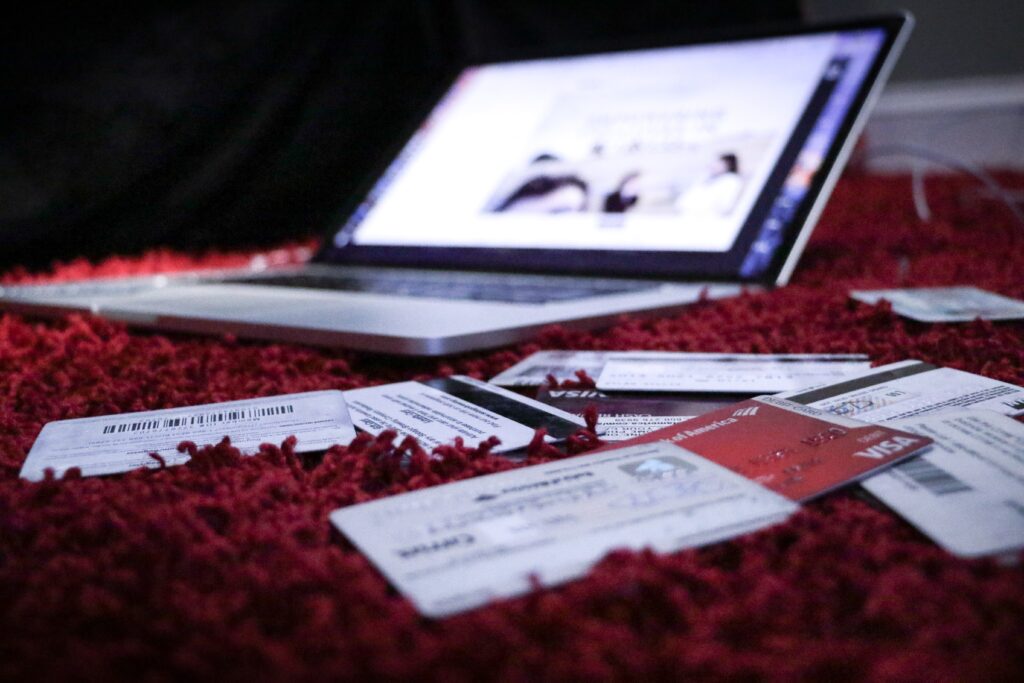

Good debt vs bad debt

Not all debt is inherently bad. When used responsibly, debt can be a tool for wealth creation. Good debt is generally associated with investments in assets that can grow in value or generate income. For instance, taking a bond to purchase property can be considered good debt, as you acquire an asset that can appreciate […]

How to stretch your medical savings

If your medical savings account for day-to-day healthcare costs tends to run out before the end of the year, here are some tips to make your savings last longer. It is important to use the money in the best possible ways. You could visit healthcare providers with lower rates, select more affordable procedures and opt […]

Cover for Airbnb hosts

If you list your home on Airbnb or any other home-sharing platform, it is crucial to inform your insurance company before opening your property to strangers. If you fail to notify your insurer, your hosting-related claims may be declined. There are risks associated with hosting guests, including property theft, damage and potential liability if a […]

What investors should know upfront

Understanding the basic investment concepts and your investment goals can make investing more meaningful and help you make informed decisions. The first step is to decide if you are investing for growth or to derive an income. You can then define your investment goal, which is what your investment needs to do and by when. […]

Preserve your retirement savings

Preserving your retirement savings when changing jobs is crucial for maintaining your financial security in retirement. Here are some ways to preserve your retirement savings: You can transfer your pension fund or retirement annuity from your employer into a separate preservation fund account. Another option is to transfer your retirement savings to a retirement annuity. […]

When should you review your cover?

It is important to review your life, disability and severe illness cover annually toensure the benefits align with your current needs and circumstances. During your review, assess how your estate would look if you were to pass awaysuddenly. Your estate should also have enough cash to cover liabilities such asestate duty, debt and other expenses. […]